Large Cap Focused

This strategy seeks long-term growth of capital with downside risk reduction by investing in large capitalization US companies with accelerating revenues and earnings. The manager’s proprietary QuantActive process seeks to combine technology-based, quantitative analysis with active, qualitative management to enhance stock selection and manage risk.

All Cap Focused

This strategy aims to outperform broad equity market indices across market cycles with less risk and has the flexibility to seek opportunities across styles. The strategy utilizes the manager’s proprietary QuantActive investment approach, combining quantitative analysis with active management to enhance stock selection and manage risk.

Long/Short Equity

This strategy is designed for investors who seek reduced downside risk, portfolio diversification, and attractive risk-adjusted returns. The manager utilizes the QuantActive process to build an all cap portfolio of US companies with accelerating revenues and earnings, while taking short positions in large cap stocks to enhance returns or mitigate risk.

Investment Process

QuantActive™, the manager’s proprietary investment approach, combines quantitative discipline, active insights, and thoughtful, common-sense risk management to create concentrated, “best ideas” portfolios.

Combining Strengths

The Integrated Alpha QuantActive™ stock selection and portfolio construction process seeks to combine the distinctive strengths of quantitative and traditional portfolio management:

- Quantitative managers benefit from powerful analytical tools to process large amounts of data, minimizing the impact of emotion on investment decisions.

- Traditional stockpickers benefit from the ability to incorporate market, industry, and company events not captured by data, and can adapt to rapidly evolving macro and business conditions, as well as black swan events.

At Integrated Alpha, we believe quantitative and fundamental techniques can complement each other to enhance stock selection, portfolio construction, and risk management.

Revenue and earnings acceleration can drive stock performance, according to academic research.

Core Beliefs: Uniting Growth, Value, and Opportunity

- Companies with accelerating revenues and earnings have historically outperformed, according to academic research.1

- These companies can be difficult for markets to value, which can create investment opportunities.

- Both value and growth companies—and not just growth companies—can exhibit accelerating earnings and revenues at various points in their business cycles, which expands our investment universe.

- Our quantitative models are designed to identify companies with accelerating revenues and earnings before the acceleration has generally been identified and priced by the market.

- We believe are different quantitative models are required for long and short positions, as the factors driving each type of position differ.

- Active risk management—which we believe is critical to long-term success—is implemented throughout the investment process.

1Ying Cao, Linda A. Myers and Theodore Sougiannis. “Does Earnings Acceleration Convey Information?” Review of Accounting Studies, Vol 16, No. 4, 2011.

Quantitative Foundation

“F-Score” = Fundamental Score

Focus on Fundamentals First

- Seek to identify companies that demonstrate accelerating revenues and earnings.

- Focus on both historical and forward-looking fundamentals.

- Our multi-factor model, based on company fundamentals, analyst estimates, and diverse data points, quantifies our insights.

- A hierarchy of diverse inputs combines multiple fundamental factors in the F-Score, including revenues, earnings, and margins.

“M-Score” = Momentum or Technical Score

Technicals Confirm the Fundamentals

- Not all companies with accelerating revenues and earnings are good stocks to own—we believe that technical factors are critical to the investment process.

- The F-Score needs to be confirmed by a strong M-Score to identify positive price movements and portfolio candidates.

- The M-Score quantifies and ranks the price movement or momentum of a stock.The M-Score quantifies and ranks the price movement or momentum of a stock.The M-Score quantifies and ranks the price movement or momentum of a stock.

- Our multi-factor model determines potentially optimal buy and sell points, by synthesizing multiple technical indicators: relative strength, moving averages, overbought/oversold, and others.

“D-Score” = Deterioration Score

Identify Short Sale Candidates

- Identifying short sale candidates is not simply the opposite of selecting buy candidates.

- The D-Score, a multi-factor model based on fundamental, technical, and valuation factors, identifies promising short sale opportunities. (Adding valuation factors differentiates the short selection process.)

- Select among short sale opportunities that exhibit deteriorating fundamentals (F-Scores) or momentum (M-Scores).

- Guard against the risk of emerging positive fundamentals or momentum by eliminating candidates or closing positions.

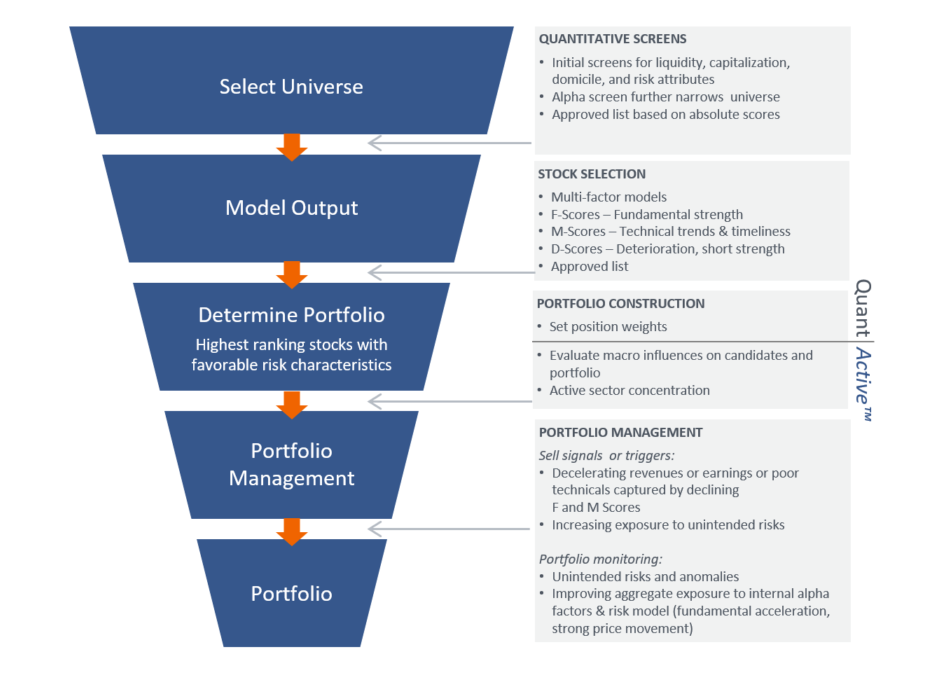

QuantActive™: Combining the Strengths of Quantitative and Active Management

The QuantActive™ process seeks to combine quantitative discipline with active risk management. We utilize a broad array of proprietary and industry data and tools to drive quantitative security selection and portfolio construction.

We then apply active risk management throughout the implementation process.

Quant

Quantitative Investment Process

- Proprietary implementation of analytical tools for security selection, factor modeling and portfolio construction

- Absolute ranking of companies based on quantitative acceleration and technical indicators

- Approved list with buy candidates

- Recommended sells

- Proposed position weights

- Sector and risk factor exposures

Active

Active Risk Overlay

- Final review of buy candidates from approved list

- Final review of recommended sells

- Final review of sector and risk factor exposures

- Review impact of macro environment on securities and portfolio

- Evaluate portfolio risk profile

- Review performance of “hold” positions’ to identify false positives

- Monitor securities and portfolio for unintended risks

Quantitative Foundation

The QuantActive™ investment process.