Economic Context

The recovery is still in play but has lost some of its momentum due to three primary issues:

- The COVID pandemic is controlled but not yet a thing of the past.

- Fiscal uncertainty in Washington – e.g., infrastructure bill, green initiatives, etc.

- Our dependence on an embattled global supply chain.

Furthermore, “Now Hiring” signs are ubiquitous across all sectors in all geographies. Many economists believed that unplugging the stimulus checks in September would send people rushing back to work. Clearly this has not been the case thus far, as illustrated by a big miss in the September non-farm payroll forecast: 194k actual versus 500k estimate. In our opinion, there are three main (negative) drivers to this unusual labor market behavior:

- COVID: Much of the labor force is not willing to go back to higher risk positions and instead will sit out until the pandemic is more controlled.

- TRANSIENT LABOR MARKETS: It is like a game of musical chairs with many times more chairs than people. Workers have more choices and have had an entire year to prepare and to rethink their prior job. This has been called “The Great Resignation.” Such dislocation is not sustainable long term. At some point, businesses will fast-track automation or simply scale back growth, rather than accept inevitably lower margins from increased wages.

- SUPPLY CHAIN DISRUPTIONS: Inventory miscalculations due to COVID and additional global friction have clogged shipping ports and caused substantial downstream effects to manufacturers and consumers.

Inflation

Inflation is in the news; we are watching but not overly concerned. We believe that current price increases are not a threat to long term economic growth. Further, we think concerns about stagflation – i.e., high inflation and limited demand – are premature and unsupported by long-term drivers.

Large Cap Focused Strategy Drivers Of Performance

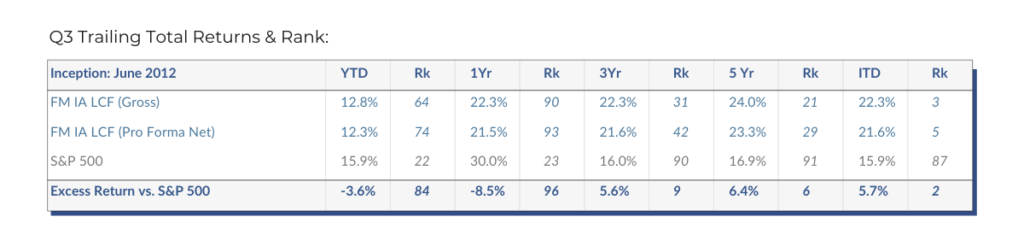

Q3 Trailing Total Returns & Rank:

Source: eVestment. Percentile Rank vs. eVestment Large Cap Growth Equity Universe. The percentile rank for each period represents the percentage of products in the universe with higher returns. The eVestment Large Cap Growth Equity Universe consists of over 300 US equity products that primarily invest in large capitalization stocks that are expected to have an above-average capital appreciation rate relative to the market. Returns for periods > 1 year are annualized.

From a portfolio manager’s perspective, the portfolio is positioned to continue its long-term behavior. Historically, when momentum factors drive broad market performance, the strategy sees compounded benefit. During periods when those factors are out of favor, the overall quality of holdings and active positioning keep the portfolio competitive with its benchmarks and peers. The QuantActive process is rigorous, and our active participation disciplined, to avoid overreaction to short term market effects. The process avoids style changes that can expose the portfolio to a whipsaw effect when momentum returns. We are always vigilant for emerging opportunities and attentive to overall risk management.

Positioning

Per mandate, we continue to hold a concentrated portfolio. Weighting to financials (banks) and retail has increased going into the holiday season.

• Over Q3, the portfolio went slightly active to Information Technology as we saw many of these names being undervalued by both our quantitative measures and traditional value metrics. This is a good reminder that our universe and toolset is agnostic to style or sector – we hold the names that fit the QuantActive process regardless of how they are classified.

• We remain neutral to mega cap FAANG stocks and remain selective on which we hold.

• We increased exposure to Consumer Discretionary, where we see solid metrics aligned with ruddy business prospects.

Outlook

Bullish. The pandemic has been largely controlled but is far from over and is likely prone to continued regional hotspots. As more people are vaccinated and new treatments become available, we are bound to see a return to normality as we learn how to live with COVID. We see this in the numbers: The sum of the consumer component of GDP is still internalizing large pent-up demand for everything from semiconductors, to cinemas, and manufacturing.

As for equity performance, continued appreciation is expected. As value investors pile into value names, those stocks become more expensive and thus no longer a value. Recall, a value investor believes his or her returns are defined by the price paid, and not how the company grows those metrics over time. Instead, we invest in companies showing accelerating earnings and revenues. Our entry point is set when those characteristics become stable; our returns are aligned with the strong growth engines those companies create. That said, some names require patience and focus on the big picture rather than chasing market trends.

Performance this year has been caught in the market’s sideways channel. We remain competitive with relevant benchmarks by owning high quality stocks that fit our style and metrics. We are confident the portfolio has accumulating upside potential that can be unlocked with positive earnings and sentiment. We will always remain vigilant to amassing this potential energy in an active, risk-controlled way.

This report was prepared by F/m Acceleration, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Neither the information nor any opinion expressed it so be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice.

This is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Performance listed is Net of fees. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance is not indicative of future results.

The “Gross” returns presented are gross of fees. The results do not reflect the deduction of investment management fees; the client’s return will be reduced by the management fees and any other expenses incurred in the management of the Fund. For example, a US $100 million account, paying a .50% annual fee, with a given rate of 10% compounded over a 10 year period would result in a net of fee return of 9.5%. Management fees are described in the Firm’s Form ADV Part 2A. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance is not indicative of future results.

The information herein was obtained from various sources. F/m Acceleration does not guarantee the accuracy or completeness of information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. F/m Acceleration assumes no obligation to update this information, or to advise on further developments relating to it.